Disposable Vapes & Cigarette Taxes: 2024 State-by-State Comparison

Disposable Vapes have emerged as major contenders in the alternatives-to-smoking market, but how do they stack up against traditional tobacco products when it comes to taxation in 2024? With the evolving landscape of cigarette tax by state 2024, understanding the fiscal realities behind each option is essential for consumers, retailers, and policymakers.

What Are Disposable Vapes?

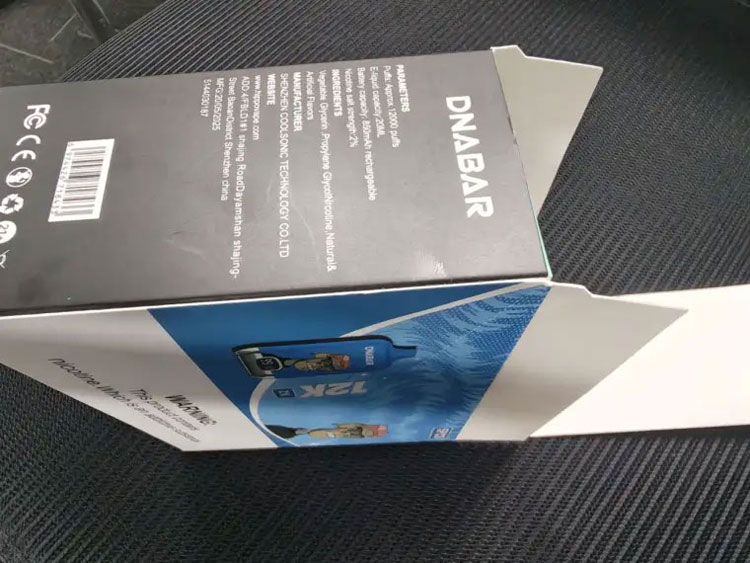

Disposable Vapes are single-use, pre-filled electronic nicotine delivery systems. Unlike reusable vaping devices, Disposable Vapes require no maintenance and are ready to use right out of the package. Their convenience and discreetness have fueled their popularity, especially among younger adults seeking alternatives to smoking. But while the health impacts continue to be debated, the financial aspect—particularly tax policies—deserves equal attention.

How State Taxes Affect Traditional Cigarettes

Cigarette tax by state 2024 refers to the excise taxes levied on cigarettes at the state level, supplementing federal taxes. These taxes vary dramatically from state to state. For instance, states like New York and Connecticut impose some of the highest per-pack cigarette taxes, while states such as Missouri and North Carolina maintain some of the lowest. The intention behind state cigarette taxes is multifaceted: to deter smoking, diminish healthcare expenses arising from tobacco use, and generate public revenue for health programs.

- High-tax states: New York ($5.35/pack), Connecticut ($4.35/pack), Rhode Island ($4.25/pack)

- Mid-range: Pennsylvania ($2.60/pack), Texas ($1.41/pack), Colorado ($2.00/pack)

- Low-tax states: Missouri ($0.17/pack), North Carolina ($0.45/pack), Georgia ($0.37/pack)

Disposable Vapes Taxation: The 2024 Update

Unlike traditional cigarettes, Disposable Vapes face a variable and often less burdensome tax regime. Many states have only recently implemented or updated taxes on vaping products, with significant differences emerging in rate and structure. Some states charge a percentage of the wholesale or retail price, while others apply a per-milliliter (ml) or flat fee for each unit sold.

| State | Cigarette Tax per Pack | Disposable Vape Tax Type | 2024 Tax Rate |

|---|---|---|---|

| California | $2.87 | % of wholesale + per ml | 56.93% wholesale + $2/ml |

| Illinois | $2.98 | % of wholesale | 15% wholesale |

| Virginia | $0.60 | None | 0% |

| New Jersey | $2.70 | Per ml | $0.10/ml |

| Texas | $1.41 | No vape tax | 0% |

This disparity has made Disposable Vapes comparatively more affordable in many states, impacting consumer trends and public opinion on vape use versus smoking.

Comparing the True Cost: Cigarettes vs Disposable Vapes

The true cost of smoking or vaping isn’t just about the retail price; taxation plays a major role. In states like New York or Connecticut, where cigarette taxes are at their peak, a regular smoker can spend hundreds of dollars more per year compared to someone using Disposable Vapes, even factoring in device costs and state vape taxes. Conversely, in states with low cigarette taxes or those that have begun taxing Disposable Vapes at higher rates, the financial advantage may be less pronounced.

State Tax Policies and Consumer Behavior

It’s clear that tax policies have a direct influence on the uptake of Disposable Vapes versus cigarettes. Higher cigarette tax by state 2024 rates push consumers towards lower-taxed alternatives like Disposable Vapes, particularly in states where vape taxes are minimal or nonexistent. Public health experts caution that these tax disparities may inadvertently encourage youth vaping, raising questions about optimal taxation frameworks. As more states review their budgets and public health objectives, expect to see continued evolution in both cigarette and vape taxation.

Economic and Social Impacts

- States with high cigarette taxes and low vape taxes may see increased vape usage, possibly undercutting revenues from traditional tobacco.

- Conversely, states with aggressive vape taxation, like California, maintain a tighter fiscal parity, reducing the gap between cigarettes and Disposable Vapes.

- These trends shape consumer choice, budget allocations, and even the progress of anti-smoking/vaping campaigns.

Regulatory Shifts on the Horizon

With mounting evidence on the health impacts of vaping and growing concern over nicotine addiction in non-smokers, state legislators are actively reconsidering their tax approaches. By balancing revenue needs with public health priorities, states may move to either increase vape taxes or offer incentives for cessation products. Numerous proposals in 2024 focus on matching vape taxes to the traditional tobacco excise, but implementation varies widely.

What Lies Ahead for 2024 and Beyond?

Disposable Vapes remain in a unique position as tax structures adapt and states experiment with regulation. Consumers should expect more states to impose per ml or percentage-based taxes, shrinking the affordability gap and impacting sales patterns. Simultaneously, the cigarette tax by state 2024 landscape will continue to respond to budget shortfalls, health initiatives, and shifting cultural attitudes toward nicotine delivery systems. Tracking these changes will be critical for businesses and consumers alike.

Tips for Smokers & Vapers in 2024

- Check current cigarette tax by state 2024 rates and vape product taxes before purchasing.

- Be aware that Disposable Vapes may become more expensive as new tax laws roll out in some jurisdictions.

- Stay informed through official state revenue websites or regulatory bulletins.

- Consider health, convenience, and long-term costs of both vaping and smoking.

Frequently Asked Questions

- How do vape taxes compare to cigarette taxes in most states?

- In 2024, most states levy higher taxes on traditional cigarettes compared to Disposable Vapes, but vape taxes are rising nationwide as states seek to close fiscal and health gaps.

- Will Disposable Vapes become as expensive as cigarettes due to taxation?

- Some states have matched vape taxes to cigarette taxes, but in many states Disposable Vapes remain more affordable, though the gap may shrink over time.

- Which states have no specific tax on Disposable Vapes?

- As of 2024, states like Virginia and Texas do not impose dedicated taxes on Disposable Vapes, but this could change with new legislation.

- Why are state tax rates on cigarettes so different?

- Excise tax rates are set independently by each state, reflecting different budget needs, public health goals, and economic conditions.