The introduction and adjustment of e cigarette tax have become key topics in debates about public health and regulatory policy. These taxes aim to reduce vaping by increasing costs, potentially deterring consumers, while generating revenue for governments. Understanding how these taxes affect consumer behavior and market dynamics is crucial for policymakers and stakeholders alike.

E Cigarette Tax: A Financial Deterrent?

One of the primary objectives of the e cigarette tax is to reduce consumption by making vaping products more expensive. When prices rise, certain consumer segments, especially price-sensitive individuals, might reduce their usage or quit entirely. However, these taxes can have complex ramifications.

The Economic Impact on Markets

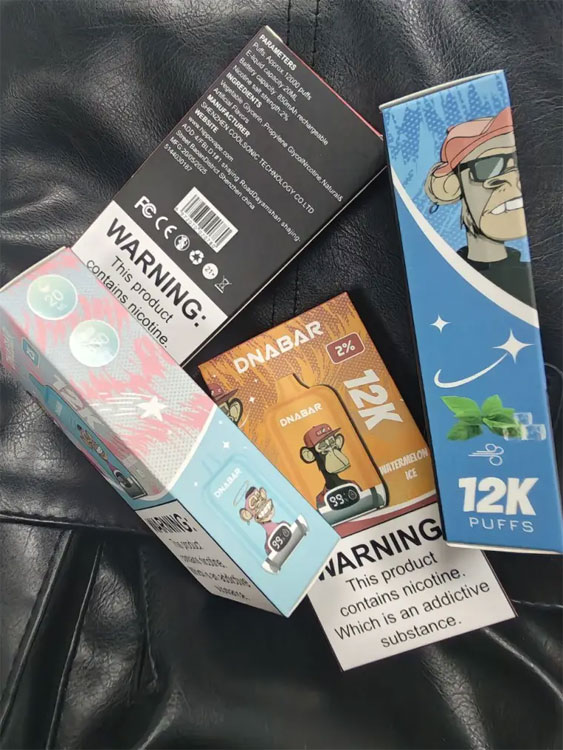

Market reactions to e cigarette tax modifications are varied. Retailers often face challenges adapting to abrupt price shifts, and some may pass costs onto consumers. This could also foster a grey market for unregulated e-cigarette products, where consumers might seek cheaper alternatives.

Regulatory Measures and Public Health

While the tax’s goal is to protect public health by discouraging vaping, it raises questions about its efficacy. Higher prices could lead consumers, especially youths, to seek traditional tobacco products as alternatives, inadvertently undermining public health efforts.

Consumer Behavior and Price Sensitivity

Understanding consumer behavior in response to the e cigarette tax requires analyzing various demographic segments. Younger consumers and those with lower disposable income are more likely to be influenced by price changes. In contrast, regular adult vapers may absorb the costs or seek bulk-buy deals to mitigate financial impacts.

“Taxation is one part of a comprehensive approach to tobacco control,” says a public health expert.

This highlights the need for comprehensive strategies that encompass education and support to assist smokers and vapers in cessation efforts.

Comparative International Perspectives

Different regions worldwide have adopted varying approaches to the e cigarette tax. The effectiveness of these policies often depends on the specific economic and social context. For instance, countries with robust public health campaigns and support systems may see a more profound impact of tax policies on vaping rates.

Lessons can be drawn from countries like the UK and New Zealand, where holistic strategies have been employed alongside taxation to achieve desired public policy outcomes.

Future Directions and Policy Recommendations

As evidence continues to unfold, policymakers must consider a balanced approach to the e cigarette tax. Future legislation could focus on a MPS, which sets a base price for vaping products to discourage excessive discounting.

Encouraging Research and Development

Government incentives could spur innovations in safer vaping alternatives and cessation products, aligning public health goals with market demands. Incentivizing research into less harmful products could potentially transform the vaping landscape.

FAQ: Common Concerns About E Cigarette Tax

Q1: How do e cigarette taxes affect youth vaping rates?

A1: By increasing costs, taxes aim to deter youth consumption, but some may turn to traditional cigarettes if they perceive them to be cheaper.

Q2: Are there any proven benefits of the e cigarette tax?

A2: While taxes can reduce consumption, their success often depends on complementary measures like educational campaigns and support for cessation.

Q3: Could taxation lead to a black market for e-cigarettes?

Could taxation lead to a black market for e-cigarettes?

A3: There’s a risk that high taxes could drive consumers to seek untaxed alternatives, highlighting the need for stringent regulatory enforcement.